Lesson 4. Stock Picking

Lesson 4. Stock Picking

Here’s three reasons you should not bother picking individual stocks for your portfolio:

(1) It’s a huge time sink. Studying company financial reports, investment newsletters and/or price charts is not the best way to spend your time. And beside, the whole idea of this website is to present a simple “no-brainer” smart approach to investing.

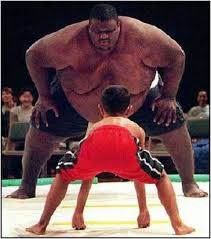

(2) Your competition is better than you. The market is not your opponent–the other traders in the market are–and not just little guys like yourself, but primarily super computers, institutional investors and inside traders). And they are better equipped, better skilled and have more information than you!

(3) The Efficient Market Hypothesis. An investment theory that states it is impossible to do any better than random chance in picking individual stocks because all known and available information is already reflected in their current prices. Watch the video below for a more detailed explanation.

Comments? Go to Web Comments or Facebook Comments. Wanna skip the lessons? Go to Recipe. Wanna stay informed? Click Join Clay’s Email List.

The No-Brainer Investor

For the investor who wants to skip the hype and just learn how to create a simple, smart and efficient portfolio.

Copyright 2014 by Clay Nelson | All Rights (and Wrongs) Reserved.