Lesson 7. Stay Balanced

Lesson 7. Stay Balanced

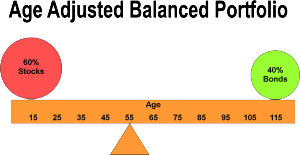

An age adjusted balanced portfolio just means that you maintain a ratio of stocks and bonds that is appropriate for your age. Because the future is uncertain, no one knows the best formula to use, but generally the idea is to have more stocks when you’re young (thus more risk), about 50%/50% when you retire, and then more bonds as you grow older (more security). The exact formula you use is a bit of luck, skill, guess, wisdom and hocus-pocus–so don’t get too hung up on it.

In the final section, Recipe, I’ll have you input your age and a spreadsheet will determine your ratio and give you a suggestion for a diversified portfolio–with the actual names of funds and where to get them. The main thing is, once you’ve made a commitment, it is essential you stick to the ratios you’ve picked. It will be so tempting to change these ratios depending on market conditions. DON’T DO. YOU MUST TAKE YOUR GUT LEVEL FEELINGS OUT OF IT AND SOMETIMES SELL YOUR BEST PERFORMERS AND MOVE THE MONEY INTO YOUR WORST PERFORMERS!

Comments? Go to Web Comments or Facebook Comments. Wanna skip the lessons? Go to Recipe. Wanna stay informed? Click Join Clay’s Email List.

The No-Brainer Investor

For the investor who wants to skip the hype and just learn how to create a simple, smart and efficient portfolio.

Copyright 2014 by Clay Nelson | All Rights (and Wrongs) Reserved.