Lesson 1. The Million Dollar Bet:

Lesson 1. The Million Dollar Bet:

In 2008, Warren Buffet (3rd riches man in the world) wagered $1,000,000 that he could pick a single mutual fund that in 10 years would outperform a pool of any five hedge funds selected by Protégé Partners–a New York hedge fund company with assets of over 2 billion dollars. (For verification of this story, google Warren Buffet’s Bet or see Business Insider, Feb 2015)

Results After 7 Years:

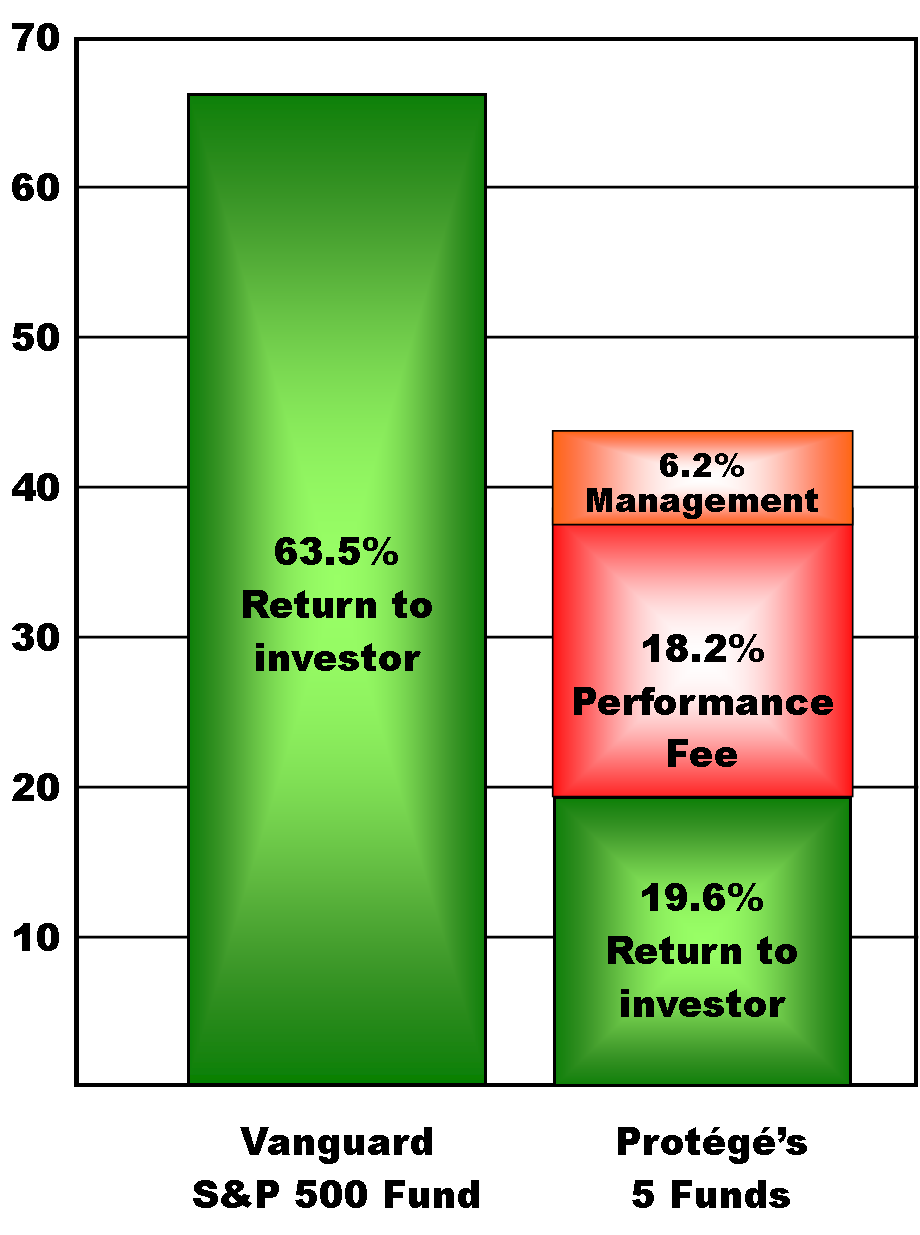

Buffet selected Vanguard’s S&P 500 Index Fund which so far has returned 63.5% to its investors, whereas Protégé’s pool of 5 hedge funds has only returned 19.6%.

Moral:

(1) In general, financial experts cannot beat the market average, (i.e., S&P 500). And in this case they’re not even close.

(2) Paying experts additional fees for management and/or advice only makes the situation worse. (Hedge funds typically charge 2% for management plus a 20% performance fee on any gains).

Furthermore, hedge funds are restricted to wealthy clients, whereas you or I can hold the Vanguard S&P 500 fund in our own portfolios.

Comments? Go to Web Comments or Facebook Comments. Wanna skip the lessons? Go to Recipe.

The No-Brainer Investor

For the investor who wants to skip the hype and just learn how to create a simple, smart and efficient portfolio.

Copyright 2014 by Clay Nelson | All Rights (and Wrongs) Reserved.